Fraud prevention shouldn’t come at the cost of customer experience

Fideo Verify is the leading real-time, AI-powered identity verification platform, built to protect customer interactions without added friction.

Verify delivers the most accurate and comprehensive identity verification on the market, consolidating fragmented verification systems into one powerful solution, all in nanoseconds and at a fraction of the cost of traditional methods.

Verify Overview (0:58)

A brief overview of Fideo Verify’s features and benefits.

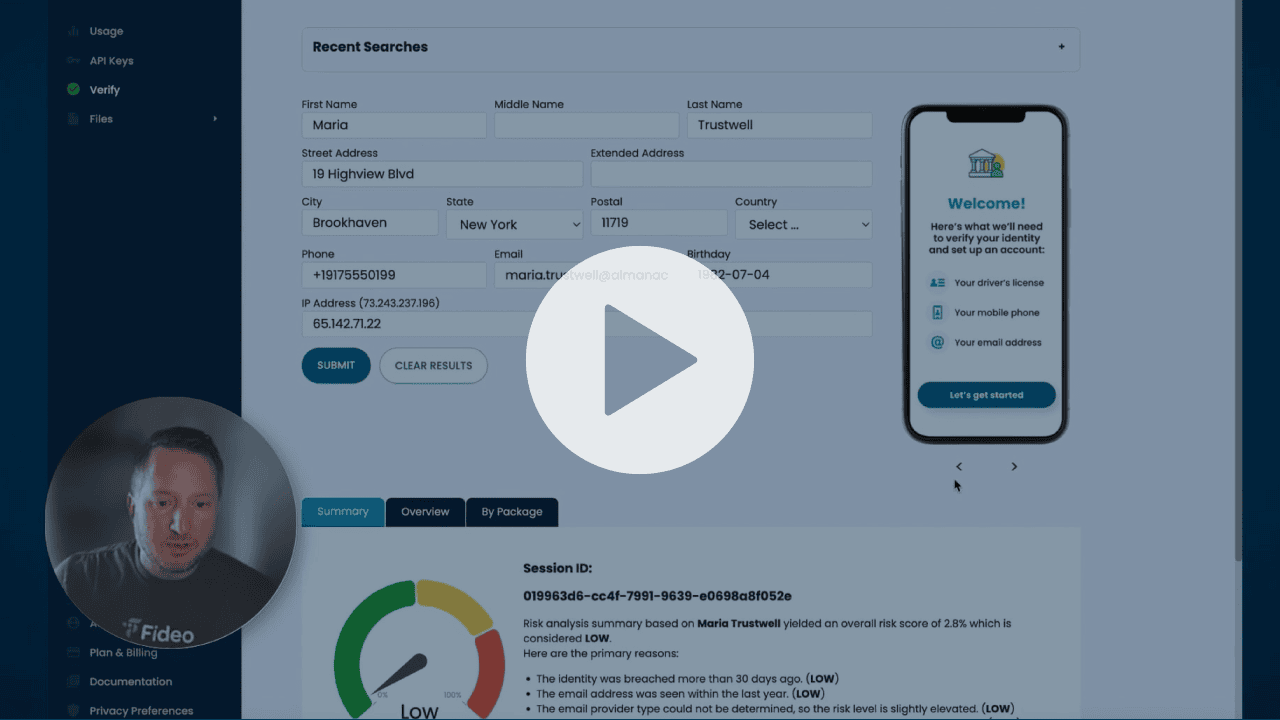

Verify Demo (5:16)

See it in action! CTO Ken Michie walks through a typical session with Fideo Verify.

Trusted by:

The most comprehensive risk score

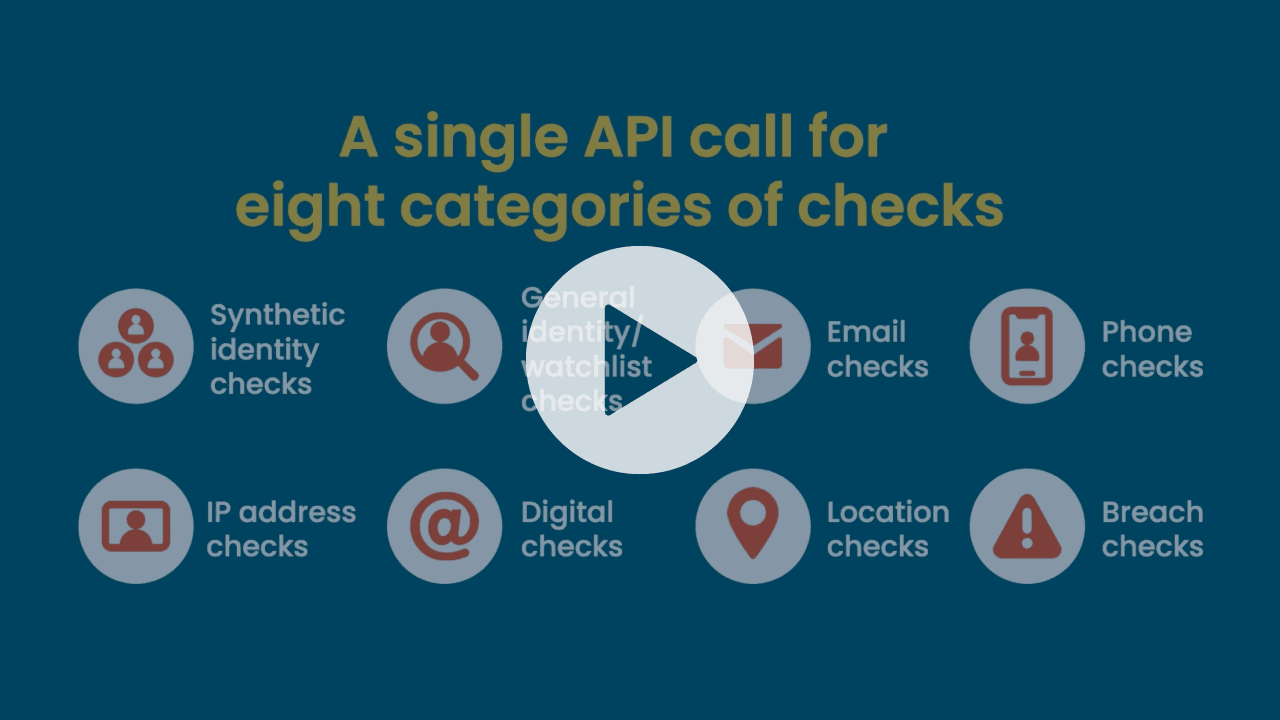

Multiple categories of checks in a single streamlined call

By unifying all essential verification checks into a single streamlined call, Fideo eliminates redundancies and closes gaps in fraud detection.

Categories of multi-layer checks include:

Synthetic identity checks

Email checks

Breach checks

Identity, sanctions, government ID checks

Phone checks

Digital checks

Location checks

IP address checks

Real-time intelligence

Unlike platforms that merely collect data, Fideo Verify generates real-time identity linkages and learns from trillions of behaviors and relationships, turning fragmented data into actionable intelligence.

Comprehensive risk scores

Fideo Verify unifies key verification checks into one streamlined call, eliminating redundancies and closing gaps in fraud detection with machine learning models that detect anomalies and adapt to new threats.

Reduced regulatory costs

Fideo reduces verification costs by screening high-risk users early and charging per customer or member, not per check. Potential risks identified are ranked, helping teams quickly escalate or reject before incurring expensive KYC costs.

Simplified pricing and integration

Fideo Verify offers per session pricing rather than per call—you pay once per user session for unlimited checks. Verify seamlessly integrates into existing workflows and partner platforms, requiring minimal involvement from your technical team.

Simplified, per-session pricing

Fideo Verify offers per session pricing rather than per call—you pay once per user session for unlimited checks.

Free evaluation

$0/month

- No credit card required

- No integration needed for testing

- 100 free sessions

- Full access to verification platform

- 8 fraud categories

- Real-time feedback

- Dynamic risk scoring

- Fraud summary description

Professional

$499/month

- Up to 30,000 sessions per year

- Unlimited calls per session

- Full access to verification platform

- No-code interface for testing

- 8 fraud categories

- Real-time feedback

- Dynamic risk scoring

- Fraud risk descriptions by attack vector

- Personal account support

Enterprise

Contact us

Reach out to our team today to discuss your goals, get personalized recommendations, and explore pricing options that fit your needs.

Connect with us to get started

Fideo’s iFIN Network

Your single source of identity risk verification

Fideo is backed by a reliable entity graph that continuously learns from our Identity Fraud Intelligence (iFIN) Network of thousands of partners and customers, providing you incredible insights to detect fraudulent patterns throughout the customer lifecycle. We flag suspicious activity before fraudulent relationships begin, strengthening your real-time verification process to distinguish between legitimate and high-risk users.

Resources

Frequently asked questions

Fideo Verify delivers the industry’s most comprehensive risk assessment by unifying eight categories of verification checks into a single API call. Unlike fragmented competitor solutions, you receive granular results from each category, a unified risk score, or both—providing complete transparency and flexibility for fraud detection decisions.

Our platform consolidates:

- Synthetic identity detection

- Identity graph validation

- Email risk modeling

- Phone risk analysis

- IP address verification

- Digital footprint analysis

- Location anomaly detection

- Breach exposure analysis

Our data comes from the iFIN (Identity Fraud Intelligence) Network, Fideo’s proprietary intelligence ecosystem that continuously learns from thousands of partners and customers. This real-time fraud intelligence graph processes billions of identity signals daily and analyzes trillions of digital behaviors and relationships. Fideo Intelligence’s data graph integrates numerous identity signals to create a unified view of over 3 billion individual identities, 307 billion identifiers and relationships, and 18 billion monthly observations. The iFIN Network creates dynamic identity linkages rather than relying on static data collection, enabling detection of emerging threats and risks that traditional verification tools miss.

Fideo Verify uses transparent per-session pricing—one flat rate per user session for unlimited verification calls. Unlike unpredictable per-call pricing models, this approach:

- Simplifies budgeting and cost planning

- Eliminates choosing between thoroughness and expense

- Makes enterprise-grade identity intelligence accessible for organizations of all sizes

- Scales efficiently for fintechs, credit unions, community banks, and non-traditional lenders

When verification fails, Verify provides detailed insights explaining specific risk factors that triggered the failure. Our risk ranking system enables fraud and compliance teams to quickly decide whether to:

- Escalate cases to enhanced compliance checks

- Reject users outright to eliminate unnecessary KYC expenses

- Approve with additional verification conditions

This proactive approach streamlines legitimate customer onboarding while focusing resources on highest-risk cases, maximizing both operational efficiency and fraud prevention effectiveness.

Fideo Verify is built with developer-ready APIs designed for rapid deployment with minimal technical lift. The platform offers seamless, no-code integration that connects directly into your existing onboarding and fraud detection workflows. Most teams can integrate and go live quickly with:

- Simple API calls requiring minimal development effort

- Comprehensive documentation and integration support

- Direct integration into existing workflows and partner platforms

- Configurable modular approach to meet your organization’s specific needs

Fideo Verify maintains enterprise-grade security with comprehensive compliance coverage designed for financial institutions. All user information is handled responsibly with robust data protection measures ensuring regulatory adherence across jurisdictions. Our platform adheres to strict data security standards and meets regulatory requirements including:

- GDPR (General Data Protection Regulation)

- CCPA (California Consumer Privacy Act)

- Additional privacy frameworks

- Financial services compliance standards

Get started with Fideo Verify

Start your journey with us to protect what you value most

Fideo protects people, businesses, and brands by powering trustworthy digital interactions and data-driven decisions. Connect with us today to learn more.